IRA or Roth IRA with 4.0% annual growth rate

Retirement Savings -

Simple and Smart

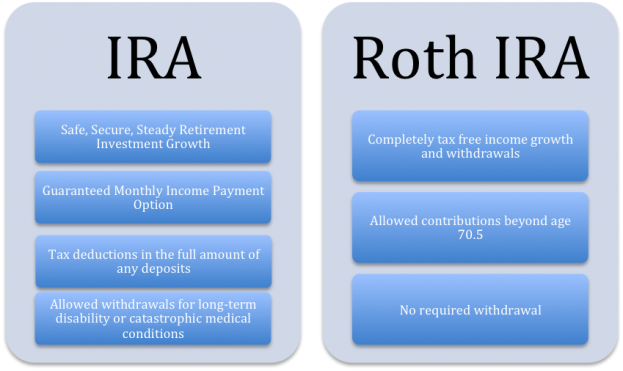

Depending on the type of IRA account, the interest earned may either be tax-deferred or tax-free and the contributions made may be tax-deductible. Consult your tax advisor to determine your opportunities.

Providence offers the effective growth rate (up to 6.35%) of a 4.0% tax-deferred or tax-free IRA, Roth IRA or annuity, which guarantees a rapid accumulation and compounding of savings. The absence of any loads (administrative fees or charges) makes sure that every dollar invested with Providence works for the client.

An individual Retirement Account (IRA)

is one of the best and easiest ways to save.

TRADITIONAL IRA and ROTH IRAs ARE THE WAY TO:

- build a safe, financially secure retirement income for your lifetime

- enjoy the benefits of tax deferral (See below chart for your effective growth rate)

- provide for your family after your death, even if you do not make any withdrawals*

- leave a significant estate for your loved ones or legacy for a charity

- save for the family’s educational needs or first-time home purchases

- establish a safe, guaranteed vehicle for your 401(k) rollovers or qualified pension plan rollovers

Interest rates will always compare favorable with CDs

Growth Interest Rate of 4%

3.5% guaranteed minimum!

Minimum Initial deposit of only $300; Additional deposit of $50.

No Term limits or CD renewal; Freedom to select the time and method of withdrawal **

** May have fees associated with early withdrawal (before 59.5).

Індивідуальний пенсійний рахунок – це один із найкращих і найпростіших способів заощадити на майбутнє.

EFFECTIVE GROWTH RATES OF PROVIDENCE

IRA and Roth IRA

(at the guaranteed minimum 2.25% rate)

The tax-deferred or tax-free features of a Providence IRAs and Annuities generate an effective growth rate higher than 3.00%, since the growth is not diminished by tax payments.

Rate your tax annuity grows: 3.50%

| Federal Tax Bracket | Effective Growth Rate: |

| 37% | 6.35% |

IMPORTANT NOTICE: FOR Additional important information (inter alia, Contribution, Adjusted Gross Income and other Limits and Qualifications) Affecting Your IRA, SEP IRA and Roth IRA Savings and Contributions for 2021 & 2022 (Click: Download Guide)

Read more information about our Roth IRA, to see if that is a good option for you.

Or check out more information on Whole Life Insurance, which offers tax free benefits!