How Much Life Insurance Do I need?

When it comes to the question fo how much life insurance do you need, most of us think about how much we would want, but we should take many other things into consideration. In many cases, what we may want is out of our current available budget. We are sharing a way to estimate your life insurance need, based on your current situation.

There are three approaches we believe will be helpful to get an idea of how much insurance your family may need after your passing.

Please contact us to get the most accurate figure based on your preferences and situation.

Ми розмовляємо Українською мовою.

Rules of Thumb

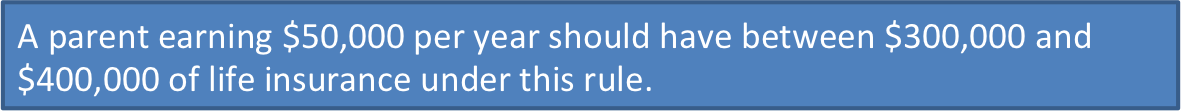

- The simplest, but least reliable, rough guide is six to eight times annual gross income.

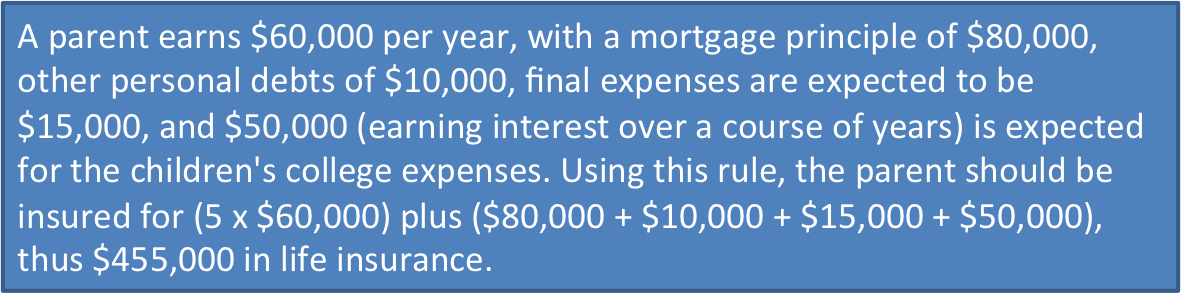

- The second rule focuses on gross income and immediate cash needs at death. Thus, calculate five times gross income, plus mortgage, debts, final expenses, and any other special funding needs (e.g. college funds). If you don’t really know what these expenses may be, we provide a helpful worksheet to estimate final needs.

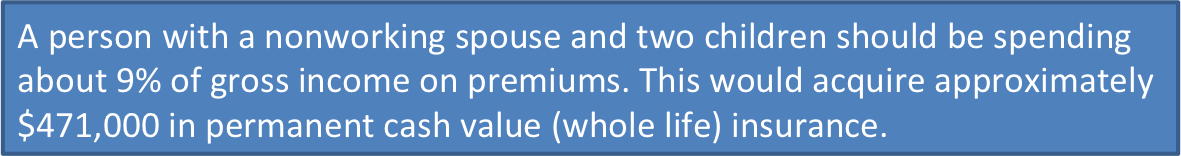

- The third rule of thumb focuses on premium payments: generally, 6% of the breadwinner’s gross income plus 1% for each dependent should be spent on premiums for life insurance.

Human Life Value Approach (Income Replacement)

This approach is originally based on concepts used in wrongful death litigation. The human life value approach is founded on the premise that the insurance need should be based on the income that would be lost if the insured dies. It estimates life insurance needs based on the economic value of the insured to the family unit.

- Calculate the present value of an individual’s future lost after-tax earnings, while taking into account both the expected duration of employment and any reasonably expected promotions and salary increases.

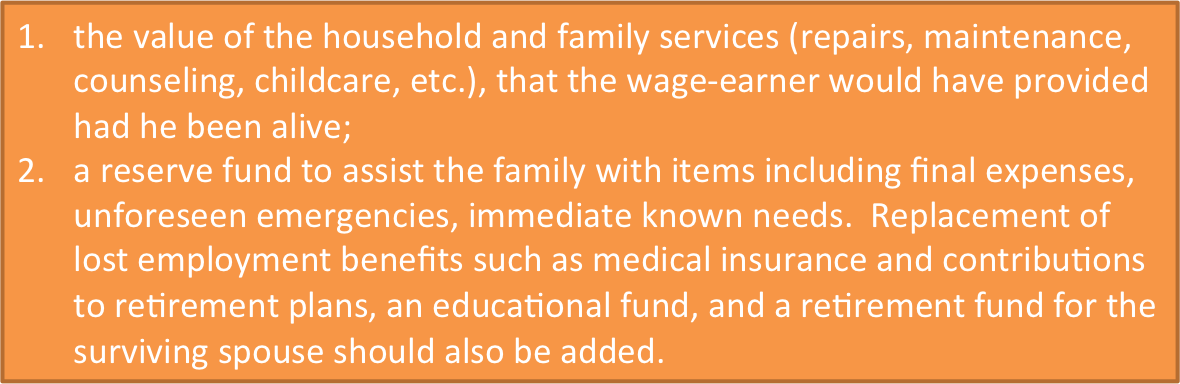

- To this figure add at least two more items:

- Subtract two items from the above figure:

3. Depending on the family’s philosophy regarding income objectives and existing savings, Add or subtract an amount.

Family Needs Analysis Approach

In contrast to the income replacement approach, the needs approach estimates the insured’s family income needs directly. The idea is to use the life insurance benefit to create that amount of money that, at present value, can provide the appropriate income stream for the family’s future.

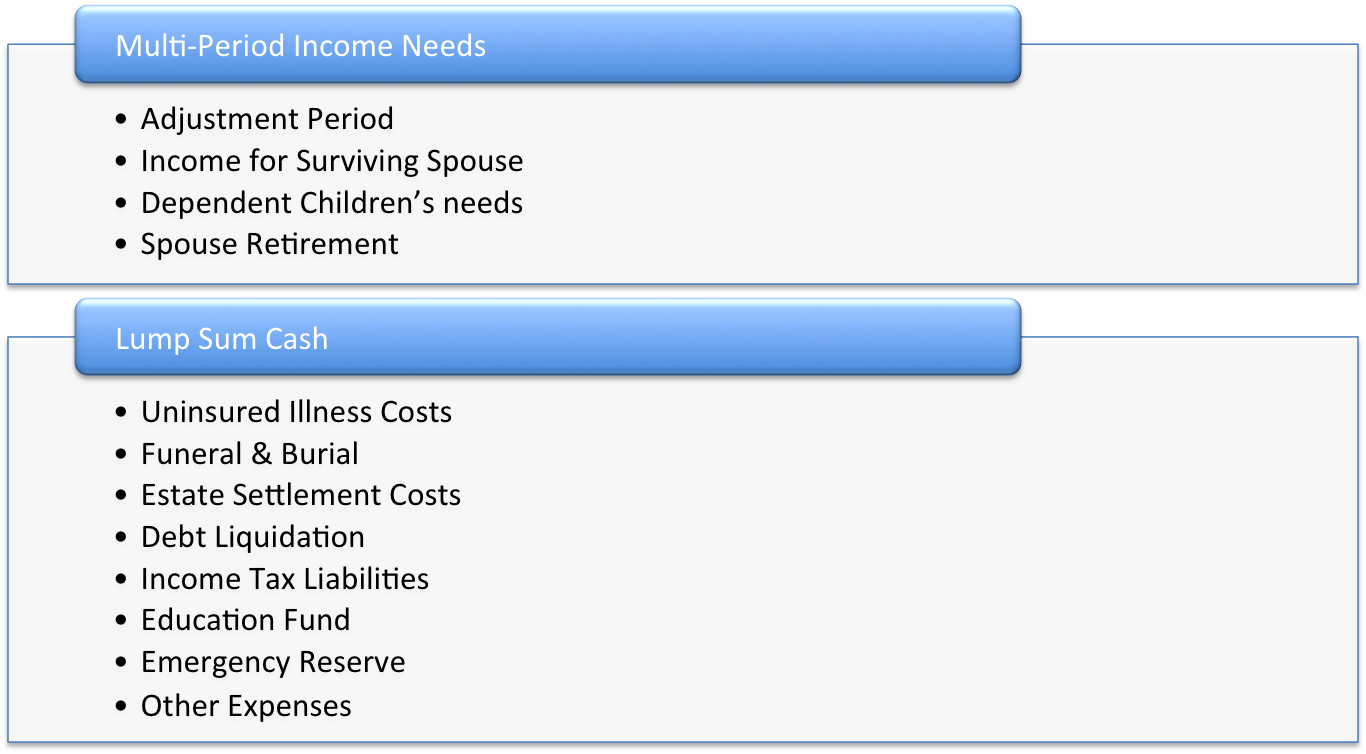

The typical needs of a family can be divided into two categories:

From this required amount, the insured should deduct Social Security survivor benefits that might be payable, but not the income stream that can be derived from the family’s existing assets, unless the family has no interest in preserving an inheritance. The analysis, in this regard, replicates the adjustments needed to accommodate the family’s investment and savings philosophy.

Reality of Deciding How Much Life Insurance I need

Although these approaches differ in calculations, when considering all three, it is likely the amount will be similar. As you live today, you don’t focus on what will happen when you are gone. We understand how mind boggling this analysis may be, especially if you are young and healthy.

Many people, of older age or who have passed already, prepared for the final hours. They prepared their clothing, important paperwork, or cash they hid away to give to their grandchildren. They have their plots, wills and everything taken care of. How can someone who is in their 30s or 40s think about these plans? The truth is, if you have children, and expenses, this is a very important plan to have make sure everything is as you want and deserve. If not for yourself, then at least, to take the pressure and stress of your children when that time comes.

We can help you make a plan, as well as answer any questions about life insurance or retirement savings. We will help you decipher the details so that you can make the right decision and have that peace of mind.